Rent Rebate Program Hershey Says -Templates are pre-designed formats or formats that work as a structure for developing records, internet sites, presentations, and numerous other materials. They offer an organized framework that streamlines the procedure of creating and arranging content, saving time and effort for users.

Bonus Property Tax And Rent Rebate Arriving Soon For Eligible

Bonus Property Tax And Rent Rebate Arriving Soon For Eligible

Importance of Design Templates in Various Area

Across numerous markets, design templates contribute in enhancing treatments, making certain uniformity, professionalism and trust, and productivity in both communication and design.

Types of Design Templates

Website Templates

Pre-designed site templates enable individuals to quickly develop professional sites without requiring sophisticated coding abilities. These design templates come in numerous layouts customized for a series of site classifications, consisting of profiles, blogs, on the internet stores, and service sites.

Professional File Formats

Organization design templates incorporate a wide range of documents important for everyday operations, including invoices, business plans, propositions, and marketing products. These design templates assist keep uniformity in branding and communication within an organization.

Educational Templates

Educational design templates satisfy the demands of teachers and students by providing organized layouts for lesson strategies, worksheets, presentations, and research documents. They boost the organization and aesthetic allure of educational materials.

Enhance Your Workflow: An Overview to Structure Effective Design Templates

Creating a layout includes creating a format and formatting components according to the desired function. Customers can utilize different software program tools and online platforms to develop and save templates for future usage.

Customization Choices

Lots of templates supply versatile features that let individuals tailor their styles to their preference. This includes customizing colors, fonts, images, and layout components to produce an individualized appearance while still retaining the theme's initial organization.

Popular Template Platforms

Various internet sites provide a selection of design templates for various demands, such as WordPress, Canva, Adobe Stock, and Microsoft Workplace. Users can browse through a range of theme collections customized to numerous markets and layout styles on these platforms.

Save Big With Hershey s Rebate 2024 Redeem And Enjoy Great Savings

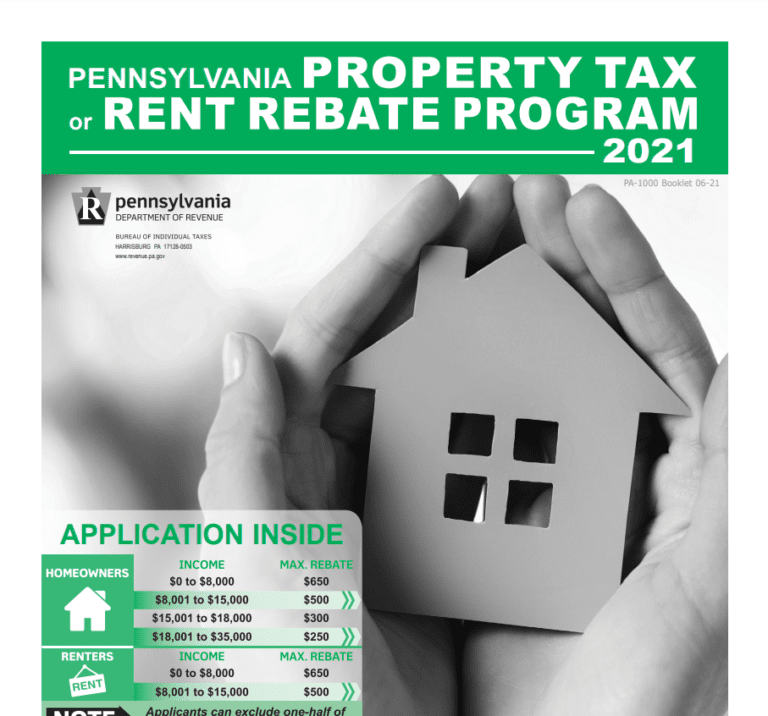

PA Rent Rebate Program Unlocking Financial Relief For Pennsylvania

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

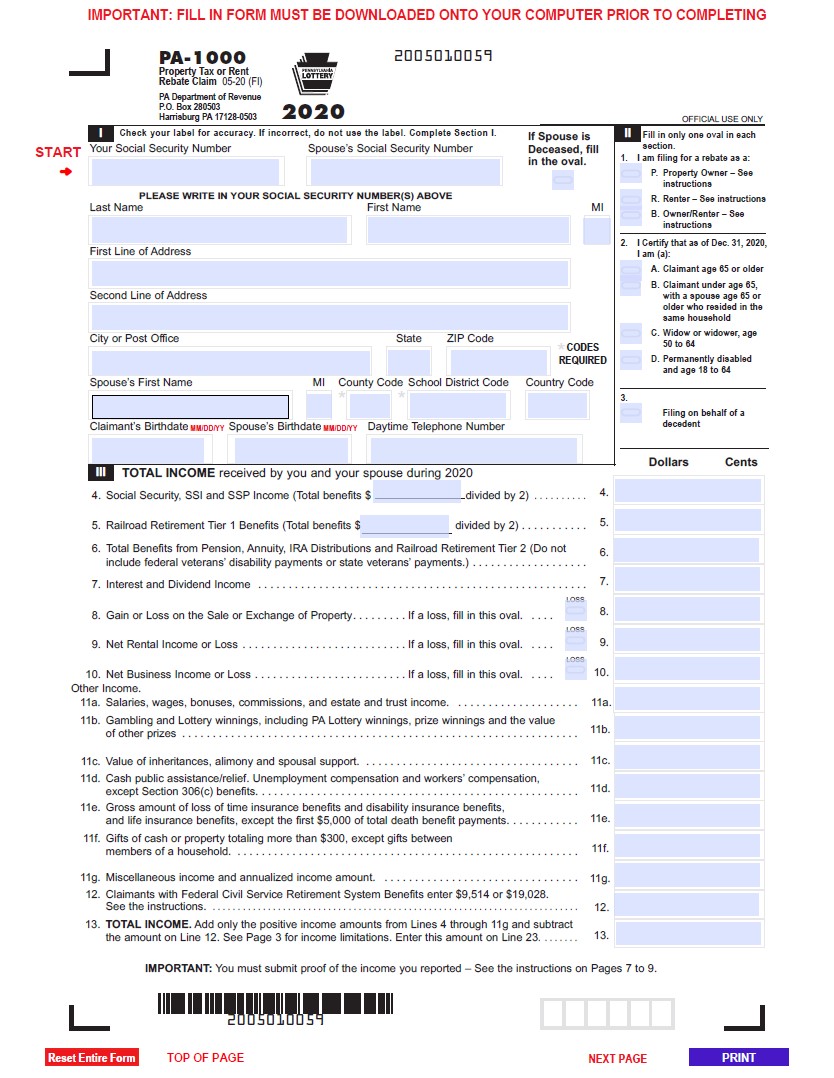

PA Rent Rebate Form Printable Rebate Form

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

2023 PA Rent Rebate Form Your Key To Financial Relief Rent Rebates

Renters Rebate 2021 Printable Rebate Form

Form For Renters Rebate RentersRebate

Property Tax Rebate Pennsylvania LatestRebate

Where To Mail Pa Property Tax Rebate Form Amended Printable Rebate Form